At least some of our readers may enjoy the local Austin blog Blueberry Town, which is written in a style eerily similar to this blog and others of lore. The Editor over at Blueberry Town hopes you pay a visit.

The Spirit of Enterprise

Celebrating and defending enterprise of all kinds.

Wednesday, April 27, 2016

Wednesday, October 2, 2013

What's the end game?

The editors of the WSJ more or less make the point I did yesterday: What's the end game of the intransigence play? Since President Obama regards the Affordable Care Act as the signature achievement of his presidency, his threat to be uncompromising on at least that question is a lot more credible than the Republican threat to cling to the Hastert Rule no matter how bad the political -- and GOP donor -- reaction might be. Credibility being the key to victory in any game of chicken, it is therefore difficult to see how this ends with anything other than Speaker Boehner waiving the Hastert Rule and allowing a vote on a continuing resolution even if he cannot get the support of a majority of Republicans. When that happens, the only question will be whether the GOP caucus tosses Boehner from the Speaker's chair and elects somebody less, er, accommodating. Smart Democrats would give Boehner something with which to save face to prevent just such an eventuality, but Harry Reid seems to be calling the shots and he is playing for the House in 2014. So, back to the Tea Party with the friendly reminder that hope is not a strategy: What's the end game?

Tuesday, October 1, 2013

Shutdown silliness in a nutshell

I both substantively agree with those who want a massively reduced federal government and I do not think that a short-term "shutdown" of the federal government matters much, even as it may spoil my beloved nephew's school trip to Washington. However, I think the Tea Party caucus in the House is blowing the tactics of it, and will set back the cause of smaller government by running the great risk that Republicans do not realize their full potential in the next two elections. Why? Because one cannot control the federal government with only the House either constitutionally or politically, and the narrative of the mostly liberal mainstream media will inexorably create pressure on the national party. How? By scaring the big GOP donor base sufficiently that John Boehner throws out the "Hastert rule" and passes a continuing resolution. The Democrats, of course, should give Boehner something to work with -- I can imagine any number of concessions, including a ban on all Obamacare "waivers" (which have gone to Democratic favor-seekers) even while demanding funding for it -- so that he can toss the Hastert Rule by some means other than consigning his manhood to Harry Reid's lockbox. No such face-saving concession will be forthcoming, however, because the Reid faction wants to humiliate the GOP House leadership in order to set up a 2014 majority.

Sunday, September 29, 2013

Renewable fuels folly

While we are looking for "discretionary" spending to cut, how about the renewable fuels initiative? Along with anything else that has a negative rate of return.

Saturday, September 28, 2013

The fiscal catastrophe that awaits

Barron's has an essential cover story for fiscal catastrophe denialists among you. Fair use excerpt, with some commentary to follow (if you know the fiscal catastrophe story by heart, delight yourself by scrolling to the bottom):

As President Barack Obama and Congress continue to bicker over passing the federal budget and raising the government's debt ceiling, a report published by one of the nation's most credible agencies warns that the U.S. could face economic disaster within 25 years due to excessive government spending.CommentaryObamacare is part of the problem, but so are Medicaid, Medicare, and Social Security. The cost of these programs will mushroom as tens of millions of baby boomers reach retirement age.

The report was published on Sept. 17 by the nonpartisan Congressional Budget Office. Its most optimistic forecast shows the federal debt growing to 100% of annual economic output by 2038, from an "already quite high 73%" today. That would make the U.S. like France, which in terms of fiscal strength is none too good.

But the CBO implicitly concedes that the outcome is likely to be a lot worse than that, and so it included its "alternative fiscal scenario," which is far more realistic. It projects the federal debt will grow to 190% of the nation's annual economic output by 2038. That would make us worse than Greece today, which has a 27% unemployment rate and periodic bloody riots over its dreadful economic conditions.

A Barron's cover story on the federal debt compared the potential fiscal crisis in the U.S. to that of Greece ("Debt Crisis: Next Stop, Greece," Feb. 18). Some critics of that shocking analogy failed to notice that it did not originate with Barron's, but with the CBO itself. In its September 2013 report, the CBO stood by that analogy.

It is a truism of American democracy that politicians' time horizons rarely extend beyond the next election. That's why you have to go back nearly 15 years to find a president squarely addressing the baby-boom budget bomb. In his State of the Union address in January 1999, Bill Clinton urged Congress to seize "an unsurpassed opportunity to address a remarkable new challenge, the aging of America." With the winds of a budget surplus at his back, Clinton declared that "now is the moment for this generation to meet our historic responsibility to the 21st century."

So much for responsibility. The big opportunity slipped away, and fiscal planning has since devolved into a series of standoffs verging on defaults and shutdowns. The latest one has Washington paralyzed right now.

DEMOGRAPHICS ARE A KEY DRIVER of future spending. By 2038, there will be 79.1 million U.S. residents 65 and over, up from 44.7 million today. The working-age population, 18 to 64, will grow at a much slower rate, to 214.7 million from 197.8 million. As a result, this "dependency ratio" will plummet to 2.7 working-age people to support each senior in 2038, from 4.4 today, as illustrated by the above chart.

But since the elderly population won't begin to reach critical mass until the mid-2020s, the rising tide of red ink will be relatively contained for the next decade. Under the alternative fiscal scenario, the increase in the debt-to-economic-output ratio will be relatively modest over the next 10 years, rising just eight percentage points, to 81%, before exploding to 138% by 2033 and 190% in 2038.

The math is pretty straightforward. Retiring baby boomers are pushing up the cost of elder-care entitlements. Mainly as a result, spending will rise much faster than revenues. Deficits will therefore be incurred ever year, adding to the debt. That the federal government can no longer be expected to balance its budget, however, is not in itself the reason the CBO calls the trend unsustainable. The trend cannot be sustained because yearly deficits will be so large that the debt will grow faster than the economy's ability to pay for it.

Because most standard projections extend just 10 years, however, the media has helped stoke complacency about the budget, ignoring repeated warnings from the CBO about the misleading nature of the 10-year outlook.

The CBO's new 25-year projections should again make the message clear: The next decade is the relative calm before the coming storm. Any short-term improvement in the budget during the recent upswing in the business cycle is negligible when measured against looming long-term shocks.

The next 10 years, in other words, should be treated as an opportunity to avert the fiscal iceberg before solutions must be so Draconian that they do damage to people involved. It is difficult enough to put 50-year-olds on notice that entitlements they expect at 70 will probably not be available. To give them this bad news when they're 60 or 65 is inhumane.

Obama seems wedded to a time frame that does not even exceed his years left in office. Three days after the release of the CBO projections, the president in a speech returned to his often-repeated point that "our deficits are now coming down so quickly that by the end of this year we'll have cut them by more than half since I took office."

That boast is hollow at best, given that those deficits were all-time records. In any case, the CBO has taken all that progress into account and still deems the budget to be on an unsustainable course. If the president's Office of Management and Budget disagrees, it should explain why.

The nation might thus be likened to a family with about 10 good working years left that needs to cut spending in order to save for a rapidly approaching old age. But alas, it's a dysfunctional family incapable of rational planning. That may be one reason that rabble-rousing Republicans seek to exploit the debt-ceiling crisis as a way to reduce the debt. As Rahm Emanuel, the president's former chief of staff, once famously said, "You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things you think you could not do before."

Such as curbing the government's addiction to debt and deficits.

IN PRESENTING THE CBO REPORT at a news conference, the agency's director, Douglas Elmendorf, said the "bottom line remains the same as it was last year," clearly referring to his agency's last long-term budget projections, released in June 2012. Three things have changed since then, altering that bottom line for the better. To begin with, a tax bill was passed in January, hiking the top marginal rate to 39.6% on earnings of more than $450,000 for married couples and more than $400,000 for individuals. In addition, the CBO assumed lower spending, based mainly on slowed growth in spending on medical care. Also, gross domestic product, the denominator of the debt/GDP ratio, has been upwardly revised going back to 1929, reflecting a broader definition of GDP.

But these changes for the better have achieved very little. The CBO's alternative fiscal scenario now puts the debt/GDP ratio at 190% by 2038, as the chart on the facing page indicates, while the June 2012 version of the same scenario put the debt/GDP ratio at 190% by 2036 -- a two-year improvement.

The alternative fiscal scenario is the most realistic of those put forward by the CBO. As the agency explains, it "incorporates the assumptions that certain policies that have been in place for a number of years will be continued and that some provisions of law that might be difficult to sustain for a long period will be modified." For example, the CBO's "baseline" scenario assumes that the law requiring cuts in physicians' fees paid by Medicare will be implemented, even though Congress has rescinded these cuts every year for the past 10 years, a maneuver famously dubbed the "doc fix." The alternative fiscal scenario more realistically assumes that the doc fix is permanent.

Similarly, the alternative fiscal scenario assumes that the automatic spending cuts under the sequester, which are unpopular with Democrats and some Republicans, will be ended, although less Draconian spending caps under the Budget Control Act will continue. As Cato Institute fellow Chris Edwards, editor of DownsizingGovernment.org, says, "The CBO's alternative fiscal scenario more realistically reflects the budget culture currently prevailing in Washington."

The CBO stipulates that its "budget projections are inherently uncertain," and of course they are. They are also too plausible for a responsible government to ignore. For starters, they are driven by demographics -- the plunge in the dependency ratio -- and if demographics is not always destiny, in this case, it should be approximately right. In fact, the fiscal accident-waiting-to-happen could also occur much sooner than the CBO expects.

For example, the agency's baseline projection for real GDP growth, which determines the denominator of the debt/GDP ratio, is 2.3% per year over the next 25 years. Since annual growth has been just 1.7% since 2000, that could be far too optimistic. Also, interest costs on the debt, projected under the alternative fiscal scenario at 6% by 2038 versus 1.3% today, might be far too low. As Director Elmendorf stressed, the projected costs of debt servicing are based on past patterns, in which the debt-to-GDP ratio rose and fell.

The future debt trajectory, however, will be unprecedented, with the debt inexorably rising faster than GDP. As the market becomes aware of this dire prospect, there is no telling how high interest rates might go.

In line with the scary projections for the debt, the CBO report reiterated its previous warnings about the "risk of a fiscal crisis -- in which investors demand very high interest rates to finance the government's borrowing needs." If interest on Treasury debt reaches levels normally associated with junk bonds, interest on private-sector debt could reach levels that impair the private sector's ability to function.

Those who deny that the debt can ever be a worry for the U.S. often point out that the debt is denominated in the same U.S. dollars the Federal Reserve has the ability to print. Ergo, there needn't be defaults on that debt. But funding the debt by running the printing press could be like pouring gasoline on a fire. In fact, in his 2007 memoir, The Age of Turbulence, Alan Greenspan warned about the dangers of monetary expansion in response to the fiscal "tsunami" brought on by retiring baby boomers, and expressed the hope that the future Fed chairman would resist pressures to expand.

As Greenspan pointed out, rapid monetary expansion not only could bring price inflation, but also could cause a decline in the dollar's exchange value against other currencies. Price inflation and exchange-rate devaluation would in turn bring a plunge in the value of the dollar in which the debt is denominated, both for domestic and foreign holders of that debt. The full faith and credit backing U.S. debt would therefore be less than full, since the debt would be paid in depreciating dollars. Result: a selloff in these bonds, bringing the surge in interest rates that the CBO warned about.

While defaults on the debt would take the form of payments in depreciating dollars, defaults on entitlement programs for the elderly will probably be in terms of actual dollar cuts. But the cuts would take the form of, say, a diminished number of drugs and treatments approved for reimbursement by Medicare, or a cap on the cost-of-living escalator governing Social Security payments, especially painful as price inflation accelerates. When government tightens our belts, it rarely does so in explicit terms.

THE CHART "Soaring Debt" tells a grim story. From 1850 to 1980, the debt/GDP ratio rose with major wars -- the Civil War, World War I, and World War II -- and then in each case rapidly fell. The Korean War of the early 1950s, and the Vietnam War of the late 1960s and early 1970s, were not accompanied by increases in the ratio. Within this 130-year interval, there was only one other time the debt-to-GDP ratio rose: with the onset of the Great Depression of the 1930s.

By 1980, however, the ratio began to show a noticeable tendency to rise in the absence of a major war or major downturn. It rose in the 1980s when the tax cuts pushed through by President Ronald Reagan were unaccompanied by commensurate spending cuts. As David Stockman, budget director during Reagan's first term, has written in his recent book, The Great Deformation, "Notwithstanding decades of Republican speech-making about Ronald Reagan's rebuke to 'big government,' it never happened."

Stockman's rogues' gallery of profligate presidents also includes George W. Bush. But he exempts Bill Clinton, whose "courageously balanced budgets were the last hurrah of the old fiscal orthodoxy."....

We offer four observations that few people will enjoy.

First, when we profligately spend money on ourselves, we are destroying the standard of living of our posterity, including young people who are alive today. The money will need to be paid back, through either crushing taxation or ruinous inflation. Regardless, we are literally planning to make our own children miserable. Any time you see government at any level wasting a nickel, remember that your child will have to pay that nickel back one way or another.

Second, there is no single solution to this demographic and fiscal catastrophe. We need to reduce our spending on entitlements (particularly for future old folks who could be saving their own money or having more loving children now), we need to tilt government policy as aggressively as possible in favor of economic growth, and we need to structure our immigration decisions to support the admission of people who will bring money, brains, and ambition.

Third, we wonder if "social democratic" welfare state policies do not contain the seeds of their own destruction. Does a safety net reduce the fertility rate to the point where it makes it almost impossible to sustain the safety net? This is a question social scientists would examine closely if they were not predisposed to support social democratic welfare state policies.

Finally, we wonder if the left's denial of the American fiscal crisis is not the direct analog of the right's denial of anthropogenic global warming. Except, of course, that the American fiscal catastrophe is far more certain and will happen much more quickly.

Release the hounds.

Friday, September 27, 2013

The world yearns

The world yearns for American leadership:

“We want American leadership,” said a member of a diplomatic delegation of a major U.S. ally. He said it softly, as if confiding he missed an old friend.We will recover American animal spirits when we have leaders who choose to foster it. Repeat that to yourself until you believe it. That's what I do.“In the past we have seen some America overreach,” said the prime minister of a Western democracy, in a conversation. “Now I think we are seeing America underreach.” He was referring not only to foreign policy but to economic policies, to the limits America has imposed on itself. He missed its old economic dynamism, its crazy, pioneering spirit toward wealth creation—the old belief that every American could invent something, get it to market, make a bundle, rise. The prime minister spoke of a great anxiety and his particular hope. The anxiety: “The biggest risk is not political but social. Wealthy societies with people who think wealth is a given, a birthright—they do not understand that we are in the fight of our lives with countries and nations set on displacing us. Wealth is earned. It is far from being a given. It cannot be taken for granted. The recession reminded us how quickly circumstances can change.” His hope? That the things that made America a giant—”so much entrepreneurialism and vision”—will, in time, fully re-emerge and jolt the country from the doldrums.

More here.

Wednesday, September 25, 2013

A graduate student rebels

A graduate student in the University of Wisconsin's History Department rebels against the regulation of speech. For conservatives who live in college towns -- as I have, almost my entire life -- it is a thing of beauty. If I were a graduate student, this is the kind of graduate student I would be. Which, of course, would mean that I would never be hired as a professor. Which makes it even more awesome.

Saturday, September 21, 2013

Saturday, September 14, 2013

Morning science moment: Digital gyroscopes

So how does an iPhone or a FitBit sense motion? Through incredibly small mechanical features embedded in the electronics. Interesting stuff.

Thursday, September 12, 2013

The scourge of unregulated dinner parties

In the category of "first world problems," the New York media is now wrapped around the axle over the revelation that people are hosting entirely "unregulated" dinner parties in their own homes. What is the world coming to?

Freedom never occurs to some people. Pun intended.

Monday, September 9, 2013

The best and worst states for pension liability

When you move to a state, you not only assume a current tax burden but a future obligation to pay off the debts of the past, including particularly public employee pension obligations. Here is a handy list of the states with the worst and best pension positions. Intellectual honesty compels me to point out that a state's position on this particular list seems relatively uncorrelated with its redness or blueness or even its reputation for honesty and good governance, or not. You may draw your own conclusions.

Friday, September 6, 2013

The jobs report sucked rocks

When Wonkblog says an Obama-recovery jobs report chews chunks, you know it does.

If you only looked at the headlines on Friday’s August jobs numbers, you’d think “Not bad!”More here.You would also be completely wrong.

Yes, the unemployment rate fell a notch to 7.3 percent, from 7.4 percent in July. Yes, the nation added 169,000 jobs, broadly consistent with the pattern of recent months.

But in almost all the particulars, you can find signs that this job market is weaker than it appeared just a few months ago, and maybe getting worse. The drop in the unemployment rate was caused by 312,000 people dropping out of the labor force. The number of people actually reporting having a job actually fell by 115,000 in the survey on which the unemployment rate is based.

And while the overall August jobs number was okay, the Labor Department revised down its estimates of June and July job creation by a combined 74,000 positions. In other words, through the summer, hiring has been quite a bit shakier than it had appeared.

Folks, we need some animal spirits around here.

Thursday, September 5, 2013

The continuing outrage

The impact of the Affordable Care Act -- Obamacare -- on the true marginal tax on labor. It is a lot uglier than advertised:

The results are startling. The ACA includes both positive and negative tax rate effects, but nonetheless all provisions combined raise marginal tax rates in 2015 by 10 percentage points of total compensation, on average, for about half of the nonelderly adult population and zero percentage points for the rest. From an aggregate point of view, the employer penalties by themselves are historically significant but nonetheless smaller than each of two of the ACA’s implicit tax provisions. The ACA will increase the national average marginal labor income tax rate about twelve times more (sic) than the 2006 “Romneycare” health reform law increased the Massachusetts average rate.Read the whole thing.

Meanwhile, technical delays plague the implementation of Obamacare.

The Coase theorem in one's daily life.

If you are going to choose to tattoo -- not my cup of tea, but neither is Budweiser -- beware of the copyright implications.

The "seven risks" to the financial markets in September, historically the worst month for stocks.

How changes in the structure of families are changing the economy.

The United States is getting relatively more competitive compared to other countries, but would be even more so with changes in Washington.

More later.

Tuesday, September 3, 2013

The connection between Airbnb and serial killers

A fascinating look at how a significant decline in serial killings over the last 30 years has enabled the rise of the "sharing economy."

Adirondack light

One of the things we love about the Adirondacks is the light.

(Big Wolf Lake, near Tupper Lake, New York, September 1, 2013)

MicroNoke Hail Mary

We at TSOE will be stunned if Mr. Softee can actually make something of its acquisition of Nokia. It seems like a long pass in to tight coverage. Of course, the $5 billion purchase price is such chump change by Microsoft's standards that one might justify the deal as an easy speculation on Nokia's apparently considerable intellectual property position. In the category of dying metaphors, even a broken clock is right twice a day.

Monday, September 2, 2013

The continuing outrage

Union vs. union: The Longshoremen quit the AFL-CIO with a big snarky bang. The resignation letter is schadenfreude bait.

The editors of the New York Times applaud the state's crackdown on payday lenders. On the one hand, even we are reluctant to defend abusive usury. On the other hand, if chronic payday borrowers are willing to pay a legitimate business huge fees, they will probably be desperate or unwise enough to pay the mob. Government regulation or intervention being the fountainhead of organized crime in this country. Oh, and on the third hand:

A prominent online lender that has increasingly run into state challenges — Western Sky Financial, owned by a tribal member of the Cheyenne River Sioux — has just announced that it will stop financing loans next month.Yeah, the NYT is complaining about Native Americans exploiting their conquerors. Write that down.

Perhaps related note: Pawn shops are growing fast because regulation has turned off the consumer credit spigot for a certain class of borrower. We report, you decide.

Wow. If this isn't enterprising, we don't know what is.

Forget the headline unemployment rate. Here is a graph of the number of people who are not working. We are destroying the productivity of our people.

More later.

Sunday, September 1, 2013

Beware subsidies of the markers of status

We were reminded today of a notion that seems missing in most public policy discussions, both left and right:

The government decides to try to increase the middle class by subsidizing things that middle class people have: If middle-class people go to college and own homes, then surely if more people go to college and own homes, we’ll have more middle-class people. But homeownership and college aren’t causes of middle-class status, they’re markers for possessing the kinds of traits — self-discipline, the ability to defer gratification, etc. — that let you enter, and stay, in the middle class. Subsidizing the markers doesn’t produce the traits; if anything, it undermines them.How might subsidies of the markers of status "undermine" the character traits that produce them? Among other possible explanations, by sending the message that deferring gratification is unnecessary, or at least undesirable, and that a purpose of government is to relieve us of that awful burden.

Work Trek

The CEO of Trek bicycles talks about his first job on the night shift of a plastics factory, and how it taught him to enjoy work he might have hated. Easier to do, of course, when you have good reason to believe that you will not be doing the same thing for the rest of your life, but a nice story all the same.

Friday, August 30, 2013

The continuing outrage

OK, really just a tab dump.

Graphical timeline of the turmoil between the bursting of the tech bubble in 2001 and the financial crisis years.

The Federal Communications Commission has to change its regulations to hit its fines-and-penalties objective of $339,884,000.00. When the continuing employment of government officials depends on extracting fines, you can bet we will identify more criminals. Republicans should introduce legislation that provides that fines and civil penalties not be "budgeted" or count toward deficit reduction, and that any such fines be returned to the citizenry as tax cuts.

Flim-flammery in the Obama administration's calculation of the benefits of regulation.

The news on American personal income is not pretty.

The massive middle class tax increases necessary to get the deficit under control if we don't deal with federal entitlements. Only click on the link if you care about the standard of living of people who today are under 40 years old.

Be well.

Whence I conference

Wednesday, August 28, 2013

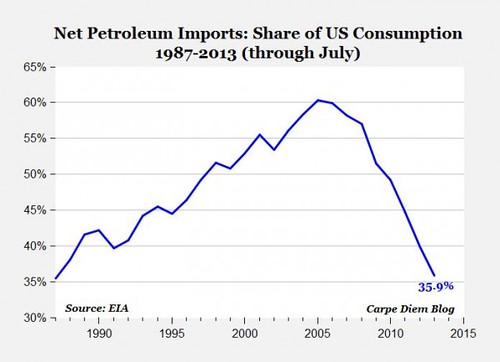

Good news: U.S. oil imports return to Reagan-era levels

In the category of good news, our net imports of oil have declined to their lowest levels since Ronald Reagan was canoodling with Mikhail.

Roll that one out at your next cocktail party.

Saturday, August 24, 2013

The demographic imperative: China's labor force has peaked

A fascinating look at China's demographic cliff, which is substantially more challenging than even in most rich countries. China will be the first large country to face a rapidly aging population without a majority having reached the middle class. Put differently, its population is aging more quickly than its economy is growing, which is never good.

Among other factoids, China's labor force peaked three years earlier than forecast, and is at the beginning of a long decline. Not only will that make China a much less interesting place to move labor-intensive manufacturing (it already being less interesting for energy-intensive manufacturing), but one is compelled to wonder whether it will be quite as large a customer as many were originally hoping.

Fortunately, there is always India.

Thursday, August 22, 2013

Clearing away the undergrowth

One of the problems with our system of business regulation -- Congress passes a law with some fairly vague generalities, and "delegates" its authority to regulatory agencies to write the actual rules with which businesses have to comply -- is that there is no meaningful mechanism for making old regulations go away. (Or, at least, there wasn't under the Obama administration established the new precedent of selective regulatory enforcement, which would be a very powerful tool in the hands of President Paul, but that is another matter.)

Now there is a proposal that could clear away the undergrowth: The Regulatory Improvement Act of 2013, recently introduced in the Senate by Angus King (Ind - ME) and Roy Blunt (R - MO). The idea is to follow the model used to close military bases:

The legislation introduced in late July would create a bipartisan Regulatory Improvement Commission, charged with recommending cuts in the regulatory regime, and the law would require Congress to vote on the proposals. This is desperately needed. The government has few processes at its disposal through which it can re-evaluate the efficacy of outdated regulations—and many members of Congress lack the expertise, time and courage to effectively scale them back.Contact your Senator and Congresscritter using this handy website, and tell them what is on your mind. A good thing to do in any case! But consider as well asking them to vote for the Regulatory Improvement Act.The King-Blunt concept is tested and has already worked remarkably well. The Defense Base Realignment and Closure Commission, an independent, bipartisan commission of experts, was established in the late 1980s to reduce the number of military bases. Politics made it nearly impossible for Congress to do the job, as it was too easy for politicians to cut deals and protect each other's pork. Instead, the commission selected the bases and reported its findings to Congress for mandatory, up-or-down, nonamendable votes.

It worked. Since 1988, there have been 121 major base closures, 79 major base realignments (which may close down part of a facility or transfer personnel away from it) and 1,000 minor closures and realignments under BRAC.

Monday, August 19, 2013

Morning reads

The nails in the coffin of "peak oil." There is no question more important to the future prosperity of humanity than the nature and supply of its inanimate energy.

New York City's tax burden -- unique among American cities in its breadth and depth -- is turning in to a real obstacle to economic growth. This is, as much as anything else, the consequence of the big reduction in earnings on Wall Street. In other words, liberals having achieved their objective of reducing income among the one-percenters in the financial industry are now going to reap the fiscal consequences. One way or the other. (We at TSOE, not being particular fans of rent-seeking, have no issue with the retrenchments on Wall Street, by the way. We do much prefer low taxes and smaller government, a solution to the current dilemma that will offend most New York voters.)

The entire history of the world on a single chart.

Kickstart 2.0? New crowdsourcing vehicles for would-be entrepreneurs.

Make something happen today.

Sunday, August 18, 2013

It's a dad's life

For all the many ads and sitcoms that portray American fathers as idiots, occasionally there is one that actually appreciates a dad's life.

The end-of-vacation work avoidance tab dump

My week in the Adirondacks is over, and it is time to confront a huge pile of work. It has been my experience over the years that going on vacation is almost as painful as not, given the consequences. Oh well. Anyway, a final bit of procrastination pushes me to dump a few of the accumulated tabs, many of which you have no doubt seen elsewhere.

What happened to Connecticut? One might point the finger at blue state policies, but the question is, why did those happen? Never underestimate The Big Sort.

We live in a curious world where the government threatens an entrepreneur for shutting down his business rather than deploying it to spy on the government's behalf. Sort of puts the old liberal saw -- "government's just a word for things we choose to do together" -- in to context.

The Democratic candidate for the governor of Virginia -- Clinton BFF Terry McAuliffe -- is, apparently, the poster boy for bad corporate governance.

In the category of bad ideas that never die...

Notwithstanding political griping to the contrary, domestic airfares have continued to decline over the last ten years, even as the price of fuel has risen.

The "inequality alarmists" are wrong, especially about executive pay. I, for one, seek no rent, and while I am paid well and have no complaints, I am also not paid much more than my point of indifference. Of course, it helps to keep one's nut decisively below one's income.

Of course, that does not mean that there is not huge pressure on the middle class.

Regulation follows propaganda in California.

The president ought not both complain about the sequester's budget cuts and separately airlift his dog at great cost. It's unseemly, and it might cause especially cynical people to think that the president does not actually believe what he says on the subject.

Back to work.

Wednesday, August 14, 2013

Sittin' in the Adirondacks tab dump

DE is in the Adirondacks for the annual vacation -- not really vacation in the sense of getting distance from work, since DE's job makes such letting go very difficult, but a nice change of pace -- but that does not mean there are not links to pass along. Herewith, a few of the accumulated.

A CEO thinks it makes sense for his company to assert defenses to a regulatory action, so the regulator goes after the CEO personally. This is both to be expected and deplored.

The IRS is going after small businesses en masse. On the one hand, one hates to sympathize with the IRS. On the other hand, as one who has acquired many small businesses and "done diligence" on many more, it is safe to say that our small businesses take much more aggressive tax positions than large public companies.

Big Brother cracks down on Bitcoin, on the theory that the state must have a monopoly on the means of exchange. Query whether a society can be truly free if its government forbids unsanctioned money.

Is the burden of student loans crushing new entrepreneurs? Yes. Oh. And yes.

Is the president correct when he says that we have to get used to lower growth? No.

Our individual indebtedness is sucking less than it used to.

The long, losing war against regulation.

More later.